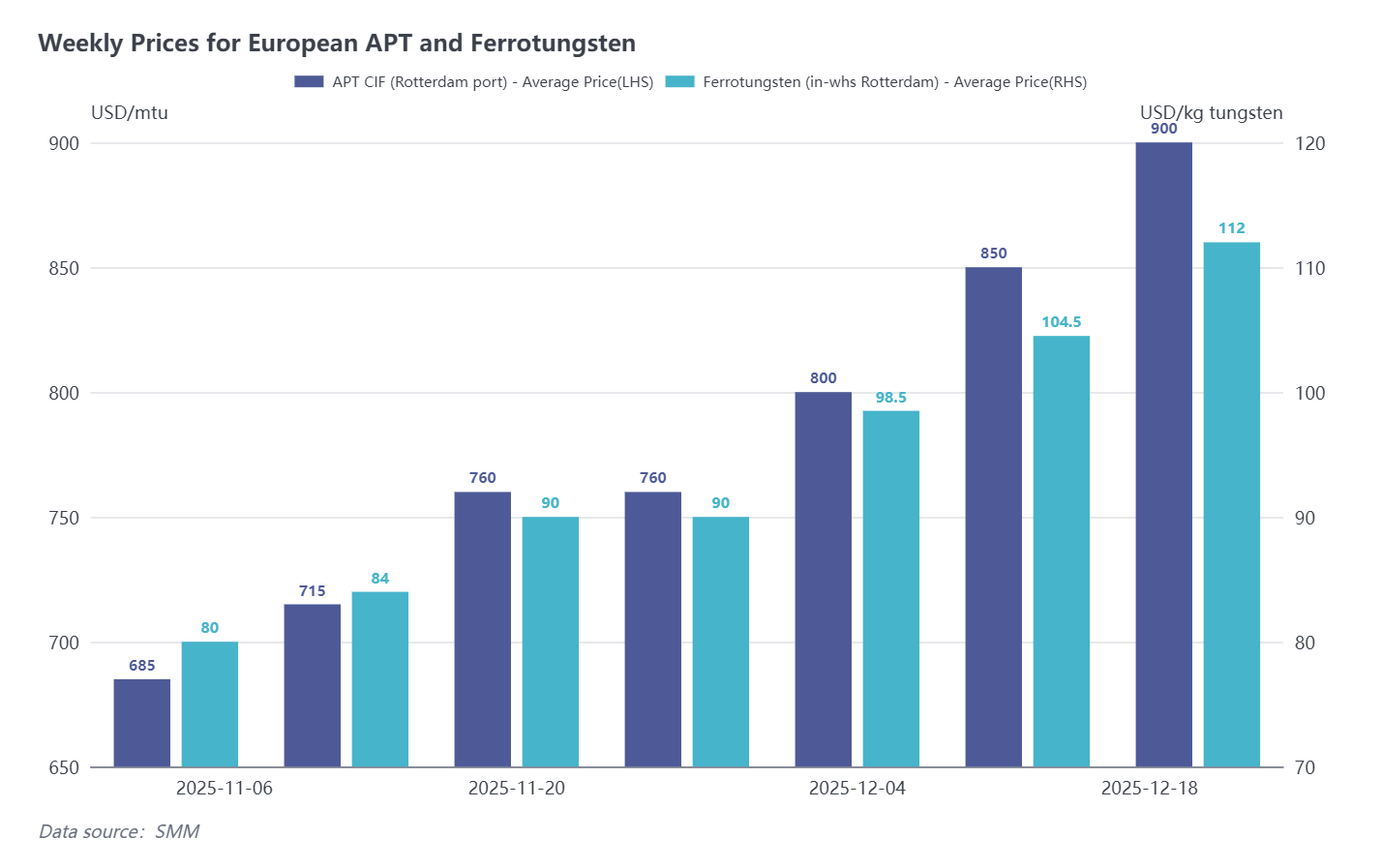

On December 19, SMM reported that the Ammonium Paratungstate (APT) CIF (Rotterdam port) price is USD 880-920 per metric ton unit (mtu), with an average of USD 900/mtu, up by USD 50/mtu from last week. Ferrotungsten (Rotterdam warehouse) price is USD 108-116 per kg W, with an average of USD 112/kg W, up by USD 7.5/kg W from last week.

China Tungsten Market: Overheated sentiment drives APT prices up by over CNY 80,000 in a week

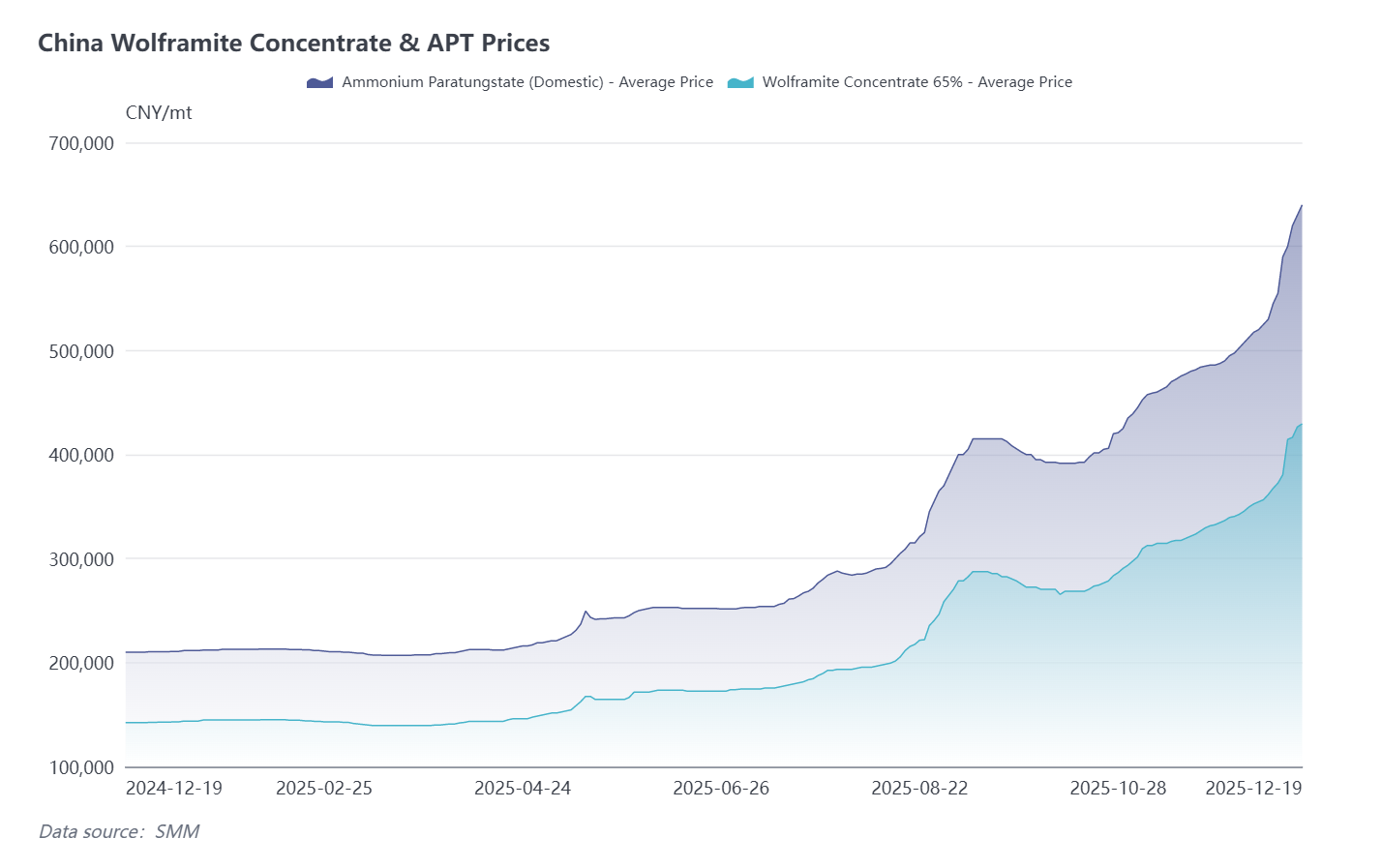

This week, China's tungsten market rose sharply. Domestic APT prices are quoted at CNY 640,000/ton (approximately USD 1,025/mtu), having surged by CNY 85,000/ton (approximately USD 140/mtu) within the week. Main reasons include: on one hand, major production regions such as Jiangxi and Hunan have very few remaining tradable mining quotas, and mines show little willingness to sell near year-end. On the other hand, multiple APT enterprises conducted concentrated maintenance this month. Market supply primarily ensures long-term contract deliveries, while spot sellers are holding back, forcing scattered urgent procurement to chase prices. Together, these factors drove overheated market sentiment and accelerated price increases.

European Raw Materials Market: Sentiment-driven rise following China; trading slows ahead of Christmas holidays

European APT traders stated: 'I am shocked that China's APT prices have exceeded USD 1,000/mtu. The rapid rise has made our end customers very nervous. As Christmas and New Year approach, customers are currently unwilling to accept current high prices and prefer to observe the market after the holidays before making purchasing decisions.'

According to SMM research, the latest transaction prices for APT in Europe remain around USD 880/mtu. However, it is expected that upstream enterprises and traders will collectively raise offers before the holiday this Friday to follow China's uptrend. Meanwhile, Rotterdam ferrotungsten offers were also raised to around USD 115/kg W.

From a sentiment perspective, Europe's rise this week was mainly driven by China's market movement: currently, Chinese prices show an inverted spread and ore supply is tight. Overseas tungsten concentrate suppliers are more inclined to divert resources to China. If European prices do not follow up promptly, securing imported ore will become more difficult. From an actual supply-demand perspective, European smelting enterprises have generally halted operations this week. End-user demand has weakened, and the subsequent two weeks enter the Christmas holiday period, leading to sluggish pre-holiday trading. The current price increase is mainly driven by sentiment.

Overseas Hard Alloy End Users: China's tungsten price rise transmits pressure; supply chain competition intensifies

Meanwhile, the sharp surge in China's market is also exerting significant pressure on overseas hard alloy end production. Currently, offers for tungsten powder exported from China have climbed to USD 151.5/kg, up by USD 21 from last week.

A procurement manager at a hard alloy producer said: 'Some Chinese tungsten powder suppliers now require cash prepayment. This will make operations even more difficult for many small hard alloy manufacturers that rely on exports and already have thin profit margins.'

However, for some urgent orders, end manufacturers still have to accept current prices and trading terms. As over 80% of global tungsten smelting resources are concentrated in China, the continuous price increase in China is gradually transmitting upstream through the downstream supply chain, driving an overall strengthening of global tungsten prices.

Regarding the future market

Affected by the Christmas holidays, current overseas market prices are not closely following China's market trend, and end-user demand has weakened as the holidays approach. It is expected that the European market will remain in a wait-and-see mode for the next two weeks, adjusting accordingly after the holidays based on China's price movements. SMM analysis suggests that the rapid price increase in China's tungsten market this week was mainly driven by a combination of temporary factors, representing an overheated market reaction. Simultaneously, some overseas suppliers with mine resources are also actively pushing up offers. In the medium to long term, attention should still be paid to changes in domestic tungsten mining policies and the actual impact of price transmission to downstream sectors.